LLPA Changes and Mortgage Rates

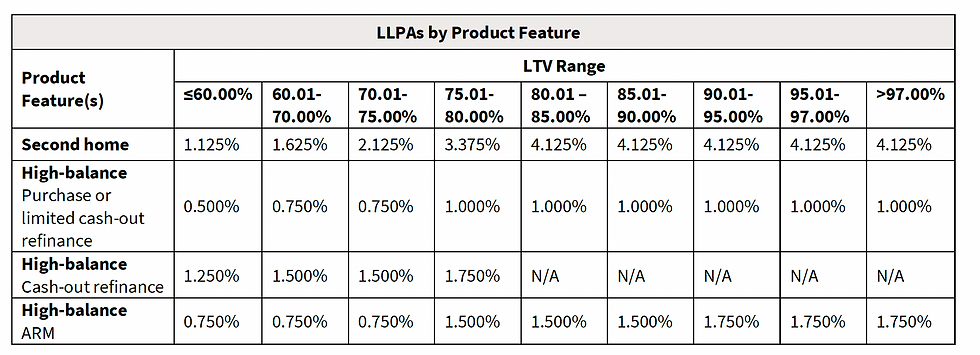

On January 5th, 2022, the GSEs released a new round of loan-level pricing adjustments (LLPAs) targeted at conforming Jumbos and Second Homes. LLPA adjustments for jumbo loans ranged from 0.5% to 1.75% depending upon loan purpose and OLTV, while those for second homes varied from 1.125% to 4.125% (see Figure 1 below). These LLPAs are effective for all whole loans purchased on or after April 1st, 2022 and for loans delivered into MBS pools with issue dates on or after April 1st, 2022. The only exemption applies to first-time home buyers with income equal to or less than 100% of area median income in order to continue to support affordable housing.

Mortgage originators usually pass the entire amount of these changes through to borrowers as increases in the effective mortgage rate. Since these changes are targeted at Jumbo (and second home) borrowers, the effect of the LLPA change is to raise their mortgage rates relative to conforming borrowers. The magnitude of the increase depends on the loan characteristics as shown in Figure 1 but making the traditional identification of 1% of the loan balance with 25bps in mortgage rates, one would expect the difference between rates on Jumbo Conforming loans and Conforming loans to increase from 12.5bps to as much as 44bps.

S-Curves and LLPA Changes

These LLPA changes provide a vivid demonstration of how mortgage rates have become increasingly tied to loan attributes and as such, also suggest why it is so challenging to interpret S-curves that aggregate across mortgage characteristics and over time (LLPAs depends upon both loan attributes and calendar time). For example, if S-curves for conforming loans (including jumbos) are constructed by just using Freddie Mac’s benchmark 30-year PMMS rate to compute incentives, then there would appear to be a sudden change in Jumbo prepayment behavior starting around April-May 2022 for the same incentive; what has really happened is that on a relative basis the effective refinancing rate for most Jumbo borrowers is about 12.5bps to 44bps higher than previously.

Inferring a Mortgage Rate for Jumbo Conforming Borrowers

Unlike conventional mortgages, where the Freddie Mac PMMS rate is widely accepted as a benchmark, there's no consensus on good sources for Jumbo Conforming rates. Our approach is to use loan-level data from the Agencies to estimate the historical note rate spread between benchmark and non-benchmark mortgages, and to then add this spread to the latest PMMS rate to estimate the prevailing non-benchmark rate. This spread estimate is updated on a monthly basis.

Figure 2 shows how this spread estimate has evolved over time and suggests that Jumbo conforming mortgage rates have increased by ~15-17bps on a relative basis in recent months for a reference population of Purchase loans with LTVs between 60-75%. This estimate relies on a loan-level analysis: since Jumbo Conforming Loans are placed both in TBA-deliverable pools (up to a maximum of 10% by balance) and standalone Jumbo conforming pools, we filter for non-conforming balances across all 30-year conforming products.

However, there is a drawback to this method because filtering for loans in TBAs just by balance doesn’t allow you to conclusively identify Jumbo loans: loan limits are based on median home values at the county level but the GSEs and GNMA do not disclose loan-level geographic information at this level of granularity, only at the state-level. Consequently, this estimate is biased downward because it will include some loans which actually have conforming balances.

Arguably, a better estimate would be to look at loans pooled in standalone Jumbo pools where the loans can definitively be identified as Jumbos. Figure 3 shows the spread estimates we obtain by using this approach. Whereas some of the trend more appropriately matches what happened at the LLPA level, clearly the estimates are much more volatile. This is because Jumbo MBS issuance is much more volatile – Jumbo conforming loans are first placed in TBAs where they get better execution and then, to the extent that excess supply exists, in standalone pools. Recently, because of the overall surge in mortgage rates, Jumbo Fannie Mae MBS issuance totaled only $85mm in April, followed by $14mm in May.

Concluding Thoughts

The above discussion shows some of the pros and cons of the different approaches to constructing S-curves for non-benchmark products. Our approach tries to pick a middle path that straddles the extremes of generating an LLPA-adjusted incentive for every mortgage or, at the other extreme, just using the conforming mortgage rate, by creating a baseline mortgage rate for every product without any loan-specific adjustments.

Comments